1. Introduction

Alberta’s economy stands at a crossroads in late 2025. With an estimated Nominal Gross Domestic Product (GDP) of around $365 billion and historically maintaining the highest GDP per capita in Canada, the province continues to punch above its weight on the national stage. While this strength is fundamentally linked to its vast energy resources, a key surprising fact in 2025 is the disconnect between strong economic activity and rising employment pressure.

Beneath the headline numbers, a fundamental transformation is underway. Driven by volatile global oil markets, increasing climate action mandates, and a massive influx of interprovincial migrants, the story of Alberta in 2025 is a narrative of transition: from an economy historically defined by oil dependency to one actively seeking diversification through technology, value-added agriculture, and a burgeoning hydrogen sector.

This article provides a detailed look at the current state of Alberta’s economy, analyzing its key sectors, major urban centers, labour market dynamics, and government fiscal policy. Whether you are an investor looking for new growth opportunities, a business owner seeking a low-tax environment, or a potential new resident planning a move, this overview will equip you with the essential information to navigate Alberta’s rapidly evolving economic landscape.

2. Current State of Alberta’s Economy

The economic performance of Alberta in 2025 is marked by robust momentum, primarily driven by record energy production and population-fueled residential construction, even as employment growth struggles to absorb the rapid influx of new workers.

Key Metrics and Quick Comparison

Alberta is forecasted by economists (TD, ATB, CBoC) to be among the top-performing provincial economies in Canada for Real GDP growth in 2025.

| Metric | Alberta (2025 Est.) | Canada Average (2025 Est.) |

| Real GDP Growth Rate | ~1.9% to 2.0% (Expected to lead provinces) | ~1.0% to 1.6% |

| GDP per capita | ~$71,600 (Highest among major provinces) | ~$55,000 |

| Unemployment Rate (Average) | ~7.4% (Q3/Q4 average forecast) | ~7.1% |

| Average Weekly Earnings (July 2025) | $1,376.53 (Highest in Canada) | ~$1,220 |

| Population | Nearing 5.0 Million | ~42 Million |

Where Alberta Ranks Nationally: Alberta leads in per-capita economic output, average weekly earnings (with year-over-year wage growth of +3.2%), and in the crucial metric of net interprovincial migration (leading the country for the 12th consecutive quarter). The primary challenge is the elevated unemployment rate, which, as noted by RBC, is a temporary “labour market absorption pressure” rather than a sign of economic weakness.

Current Challenges

- Oil Price Volatility: Government revenue remains highly exposed to global energy prices. While production is high, price fluctuations and maintaining the cautious WTI forecast (Budget 2025 benchmark of US$63.75) create fiscal planning uncertainty.

- Skilled Labour Shortages: The residential construction and healthcare sectors face acute shortages. The high volume of $26.1 billion in planned infrastructure and public capital spending over three years puts intense pressure on the availability of skilled tradespeople.

- Trade Protectionism: Global trade risks and geopolitical uncertainty dampen business confidence and can slow private-sector investment. Although energy exports benefit from lower exposure to U.S. tariffs (Conference Board of Canada), non-energy exports to the U.S. have underperformed the national average.

- Office Vacancy: Calgary’s downtown core continues to face structural challenges. The downtown office vacancy rate is still high, with Q3 2025 data showing a rise in sublet space, signaling ongoing corporate right-sizing despite significant inventory removal via office-to-residential conversions (CBRE).

Current Opportunities

- Hydrogen and Decarbonization Economy: The province is leveraging its existing infrastructure and natural gas resources to become a leader in the blue hydrogen economy, supported by major Carbon Capture and Storage (CCS) projects.

- Tech Sector Growth: Calgary captures 74% of Alberta’s venture capital deals, and the city’s innovation ecosystem is actively focused on technology, finance, and aerospace/defence. This, combined with low corporate tax rates, drives private investment in high-growth knowledge industries.

- Market Access (Trans Mountain Pipeline): The full operation of the TMX pipeline is the critical factor for the energy sector in 2025. Record production levels (YTD growth of +3.6% in oil production through August 2025, per the AER) are now supported by increased export capacity, which has led to a significant boost in non-U.S. exports (Document 9).

- Interprovincial Migration: The massive, sustained net inflow of new residents—driven by affordability—is the primary factor buttressing consumer spending and the residential housing market in 2025 (RBC, TD).

3. Key Economic Sectors

Alberta’s economic strength is shifting from reliance on a single commodity to a more distributed portfolio of resilient and growth-oriented industries.

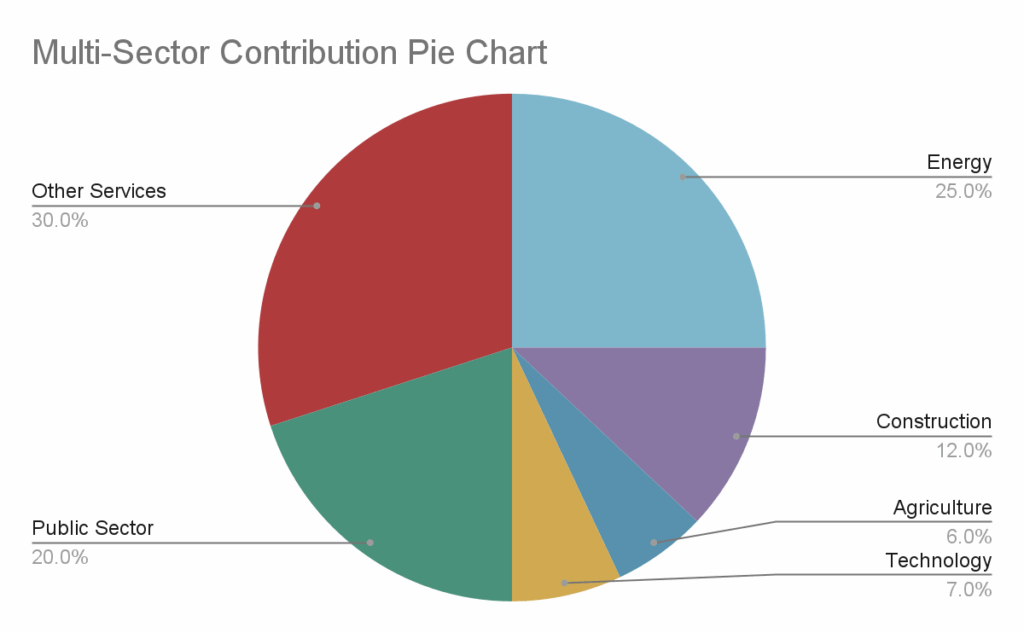

Estimate sector shares of Alberta GDP (illustrative)

A. Energy Sector

The Energy Sector remains the foundational engine of Alberta’s economy.

- Current State: Total oil production for January–August 2025 reached 157.5 million cubic meters (Mm$^3$), a YTD increase of +3.6% over 2024 (AER). Non-conventional oil (oil sands) accounted for 84.7% of this output. Natural gas producers are also set to benefit from the start of Liquefied Natural Gas (LNG) exports from the B.C. coast, a key diversification boost for the sector (ATB).

- Recent Developments: The key story is the transition in investment focus: the primary capital allocation is now on sustaining existing production and maximizing pipeline capacity rather than major new greenfield expansions (ATB). This limits the sector’s immediate torque on job creation but maximizes export revenues.

- Future Outlook: The focus on decarbonization is driving massive capital investment in CCUS and hydrogen. Projects like the Dow Path2Zero petrochemical facility are crucial examples of leveraging energy resources for value-added, lower-carbon industrial production.

B. Technology Sector

Alberta’s tech sector continues its rapid expansion, leveraging local talent and a low-cost base. The Professional, Scientific, and Technical Services sector is a significant employer in urban centers, especially for small businesses (ATB).

- Growth Story: The sector continues to be centered in Calgary (leading in venture capital) and Edmonton (known for AI and innovation). The availability of skilled technical talent transitioning from the energy sector provides a strong foundation for future growth.

- Why It’s Growing: Competitive tax rates and operational costs compared to major coastal Canadian tech hubs remain key attractors for investment and talent migration.

C. Agriculture & Food Processing

- Scope: Alberta is the Canadian leader in cattle ranching and a major producer of grain crops. The focus continues to shift toward value-added processing—turning raw commodities into finished food and consumer products—which provides higher economic stability and rural employment.

- Challenges and Opportunities: The sector has historically shown strong long-term labour productivity growth, significantly outpacing the overall provincial average since 2000 (ATB). The challenge lies in managing climate impacts while leveraging export markets.

D. Construction & Real Estate

This sector is a major pillar of non-energy economic activity in 2025.

- Current State: Construction activity is booming. Residential housing starts are on pace to hit record levels (TD forecasts 56,500 units for 2025), driven entirely by the need to house the rapidly growing population. Non-residential construction is buttressed by the government’s robust $26.1 billion three-year Capital Plan (Alberta Government).

E. Other Key Sectors

- Healthcare and Social Assistance: Driven by the growing population, this public sector area is a major focus of government expenditure and employment.

- Financial Services: Primarily based in Calgary, the sector is leveraging the city’s corporate concentration to grow beyond its traditional energy financing roots.

4. Major Cities Economic Profiles

Calgary (The Corporate and Diversification Hub)

Calgary, with a metro population of 1,562,600 as of April 2025, remains a powerful economic engine.

- Economic Profile: Calgary maintains the highest concentration of corporate headquarters per capita in Canada (Calgary Economic Development). Its economic momentum in 2025 is defined by sustained population-led demand and competitive corporate advantages.

- Housing Market: The housing market is experiencing continual strong momentum, with high benchmark price growth (projected at 3-5% increase for the average home price in 2025). The biggest challenge is persistently low inventory combined with high demand (Calgary Economic Development).

- Challenges: The downtown office core still faces immense structural headwind. While the Office-to-Residential Conversion program is actively removing inventory, sublet space continues to rise in Q3 2025, indicating ongoing corporate rationalization and a sustained “flight-to-quality” (CBRE).

Edmonton (The Stable Capital and Innovation Engine)

Edmonton’s metro economy, while experiencing the same population influx, is characterized by stability and affordability.

- Economic Profile: Edmonton’s economy is anchored by its robust public sector (government, healthcare, education), offering more predictable employment growth than Calgary’s corporate sector (Edmonton Global). Construction is surging, with the total value of building permits issued in the first half of 2025 reaching $2.8 billion, a 39% increase over the previous year.

- Real Estate Market: The Edmonton market remains significantly more affordable than Calgary (Edmonton Global). The market is described as balanced, offering stronger cash flow potential for investors.

- Labour Market: Edmonton’s Q2 2025 unemployment rate was 7.5%. Its real average weekly wage was at its lowest Q2 level in 15 years (adjusted for inflation), suggesting that while nominal wages grew, inflation eroded real purchasing power in the first half of the year (Edmonton Global).

Side-by-Side City Comparison Cards

| Feature | Calgary | Edmonton |

| 2025 Metro Pop. | 1.56M | 1.51M |

| Economic Type | Corporate Hub | Public Sector Anchor |

| Housing Price Growth | +3–5% | +1–2% |

| Key Sector | Tech & Finance | Government & Healthcare |

| Office Vacancy | High (Downtown) | Stable |

| Affordability | Moderate | High |

5. Labour Market Analysis

Alberta’s labour market paradox—strong job creation, high unemployment—is the defining feature of 2025.

Employment Trends

- Unemployment: The provincial unemployment rate was 7.8% in September 2025 (Statistics Canada). This is due to the labour force growing faster than job creation. Strong employment growth of +1.7% in September (Statistics Canada) confirms that hiring is active, but the sheer volume of new job seekers puts upward pressure on the jobless rate.

- Wages and Income: Average Weekly Earnings were $1,376.53 in July 2025 (Statistics Canada), maintaining Alberta’s lead in Canadian income levels.

Migration Patterns

Alberta leads the country in both interprovincial and international migration. The influx provides a critical supply of young workers, but this rapid growth poses immediate challenges. The labour market is absorbing newcomers, but the process is creating the highest urban unemployment rates in years (RBC). New federal policies have started to moderate the influx of non-permanent residents, which RBC projects will give the labour market “more room to adjust” toward normalization in 2026.

6. Government Finances & Policy

Provincial Budget Overview

The Budget 2025 is forecasted to swing into a deficit for the 2025-26 fiscal year after several surpluses.

- Fiscal Status: The government projects a deficit due to economic uncertainty, fluctuating oil prices, and the rising permanent costs associated with rapid population growth (Alberta Government).

- Key Policy: The 2025 Capital Plan allocates over $26.1 billion over three years to address growth pressures in health, education, and transportation networks (Alberta Government).

Key Policies Affecting the Economy

- Tax Advantage: Alberta remains the only province without a Provincial Sales Tax (PST) and committed to lowering the personal income tax rate to 8% on the first $60,000 of income (Budget 2025), a massive draw for both businesses and households.

- Investment Incentives: Strategic capital spending and incentives are focused on mega-projects in the petrochemical, hydrogen, and technology sectors to de-risk the long-term economy.

7. Economic Outlook & Future Trends

The consensus among economists (TD, ATB) is cautious optimism: Alberta’s growth will continue, but the journey will be uneven, and the provincial economy is well-positioned to weather global turmoil better than most other provinces (ATB).

Short-term (2025-2026)

- Key Factors to Watch: Continued stable oil prices above the budget benchmark, sustained housing activity (forecasted to remain high), and the successful integration of TMX.

- Prediction: Real GDP growth is expected to slow slightly to around 1.6% in 2026 (TD), but the unemployment rate is forecasted to gradually normalize toward 7.1% as the labour market absorbs the recent influx of migrants (RBC).

Long-term Structural Changes

- Diversification Success: The shift to value-added industries like blue hydrogen and petrochemicals (e.g., Dow’s Path2Zero) is the primary long-term hedge against oil volatility.

- Demographics: The massive influx of young, working-age people is the single most critical long-term asset, providing the labour supply and consumption base needed for growth through 2030 and beyond.

8. What This Means for You

If you’re a business owner or investing (like your friend and you):

The business environment is optimized for low operating costs and high profit retention, reinforced by the lowest corporate tax rate and no PST.

- Real Estate: Residential real estate remains a strong investment, with benchmark prices continuing to rise (3-5% increase projected in Calgary). Commercial real estate investment should focus on Suburban Class A/Trophy assets (CBRE) and industrial logistics, while carefully considering the risk of high downtown vacancy rates.

- Best Opportunities: Focus on the Migration Boom (construction materials, home services, consumer retail) and the Energy Transition (engineering, project management, and specialized service contracts for hydrogen/CCS infrastructure).

If you’re considering moving to Alberta:

The job market is active, but competition is fierce due to the influx of new workers.

- Best Prospects: Target the Construction, Healthcare (nursing, specialized medical roles), Logistics (trucking), and Skilled Trades sectors.

- Affordability Edge: The low-tax environment (no PST, new lower personal income tax bracket) and relatively lower housing costs (Edmonton is still significantly more affordable than Calgary) offer a massive financial advantage over Canada’s coastal cities.

9. Conclusion

Alberta’s economy in 2025 is a study in resilient strength undergoing accelerated change. It maintains its status as Canada’s economic powerhouse in terms of output and income, built on the steady foundation of its massive energy reserves and enhanced export access. Yet, its future trajectory is increasingly defined by its commitment to bold diversification projects. While managing fiscal volatility and a high but transitional unemployment rate remain key challenges, the unprecedented influx of people and strategic infrastructure investment paint a picture of forward-looking optimism. Alberta isn’t just weathering the global economic transition; it’s actively seeking to lead it.

10. External Source Links and Data Portals

This article leverages data and forecasts from the following authoritative public and private sector organizations:

Government & Official Statistics

- Labour Market & Wages (Statistics Canada): Statistics Canada – Labour Force Survey

- Provincial Fiscal Status & GDP (Alberta Government): Alberta Government – Economic & Fiscal Updates

- Oil & Gas Production Data (AER): AER – Data & Statistics

- Demographics & Population Growth (Statistics Canada): Statistics Canada – Population & Demography

Economic Forecasts & Financial Institutions

- Provincial Forecasts (TD Economics): TD Economics – Provincial Forecasts

- Provincial Outlooks (RBC Economics): RBC Economics – Provincial Outlooks

- Economic Insights (ATB Financial): ATB Financial – Economic Insights

- Macroeconomic Outlook (CBoC): CBoC – Provincial Economic Forecasts

Urban & Commercial Market Data

- Calgary Research & Data (CED): Calgary Economic Development – Research & Data

- Edmonton Economic Updates (Edmonton Global): Edmonton Global – Economic Updates

- Commercial Real Estate (CBRE): CBRE Canada – Research & Reports