Cost of Living in Calgary vs Edmonton, Canada: The Definitive Comparison

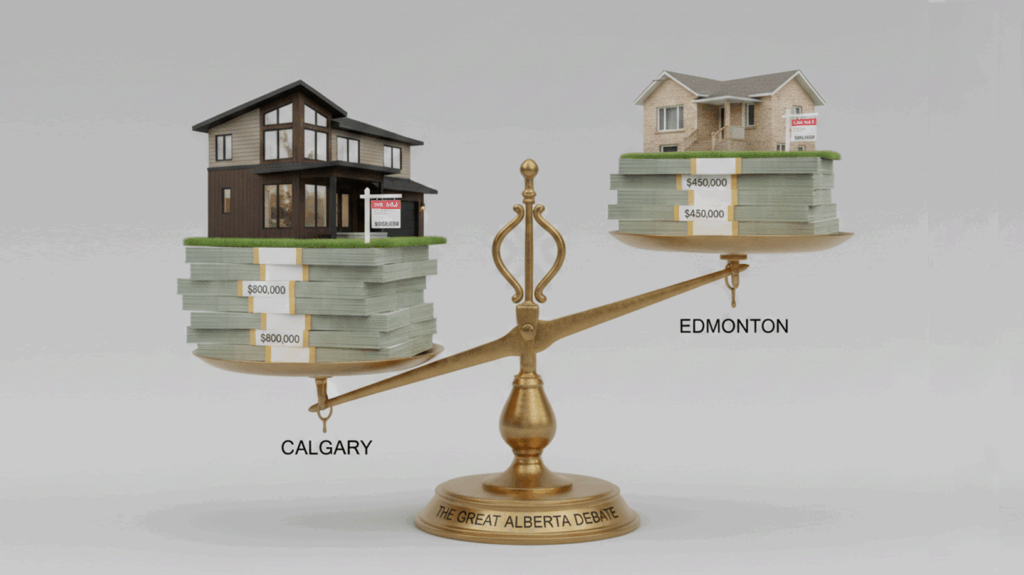

1. Executive Summary The "Great Alberta Debate" between Calgary and Edmonton often boils down to a simple trade-off: Calgary offers higher incomes and bigger-city amenities but comes with a significantly…