1. Executive Summary

1.1 Key Takeaways

The 2022-2025 period has marked a historic demographic realignment in Canada. The trend, accelerating into 2026, is clear: a massive, sustained net inflow of Canadians, primarily from British Columbia and Ontario, is reversing Alberta’s “exodus” years of the late 2010s. Latest 2025 data from Statistics Canada and the Alberta Economic Dashboard confirms that while the absolute peak of 2024 has moderated, the net gain remains exceptionally strong, with tens of thousands arriving. This shift is not a simple repeat of past oil booms. It is a rational economic migration driven by a profound “affordability push” from the Greater Vancouver (GVA) and Greater Toronto (GTA) areas, where housing costs have decoupled from local incomes. This “push” is met by a powerful “opportunity pull” from Alberta, which offers a rare combination of high median incomes, a diverse and growing job market, and a significant cost of living advantage—chief among them, the continued possibility of homeownership.

1.2 Who This Guide Is For

This guide is for anyone seeking to understand this powerful trend.

- Potential Movers: Families and individuals in the GVA and GTA weighing the financial and lifestyle trade-offs of a move.

- Investors: Real estate and business investors looking to understand the demographic fundamentals driving the Alberta market.

- Employers: Alberta-based businesses navigating a rapidly expanding—but also tightening—labour pool, and B.C./Ontario businesses considering an expansion to access talent.

- Curious Residents: Albertans, British Columbians, and Ontarians seeking to understand the data behind the headlines.

1.3 Why Now? (2025–2026 Inflection Points)

While the trend began in 2022, 2025-2026 represents a critical inflection point. The compounding effects of record-breaking population growth are now being felt. Housing prices in Alberta, particularly in Calgary, are rising at one of the fastest rates in the country, narrowing the affordability gap. Simultaneously, the job market is in a fascinating “disconnect”: while the economy is forecast to lead the nation, the labour force is growing so fast that unemployment rates in major cities have ticked up, even as tens of thousands of new jobs are created. This guide examines the opportunity and the strains at this pivotal moment.

1.4 Alberta at a Glance (Late 2025 Data)

- Population: ~4.85 Million (and growing fast)

- GDP Growth (2025-2026): Forecast to lead Canada, with ATB Financial projecting 1.9% real GDP growth in 2025 and 2.1% in 2026.

- Job Market: High job creation in construction, healthcare, and tech. However, the influx of job seekers has pushed unemployment rates up in major centres (e.g., ~8.0% in Calgary, ~8.9% in Edmonton as of late 2025).

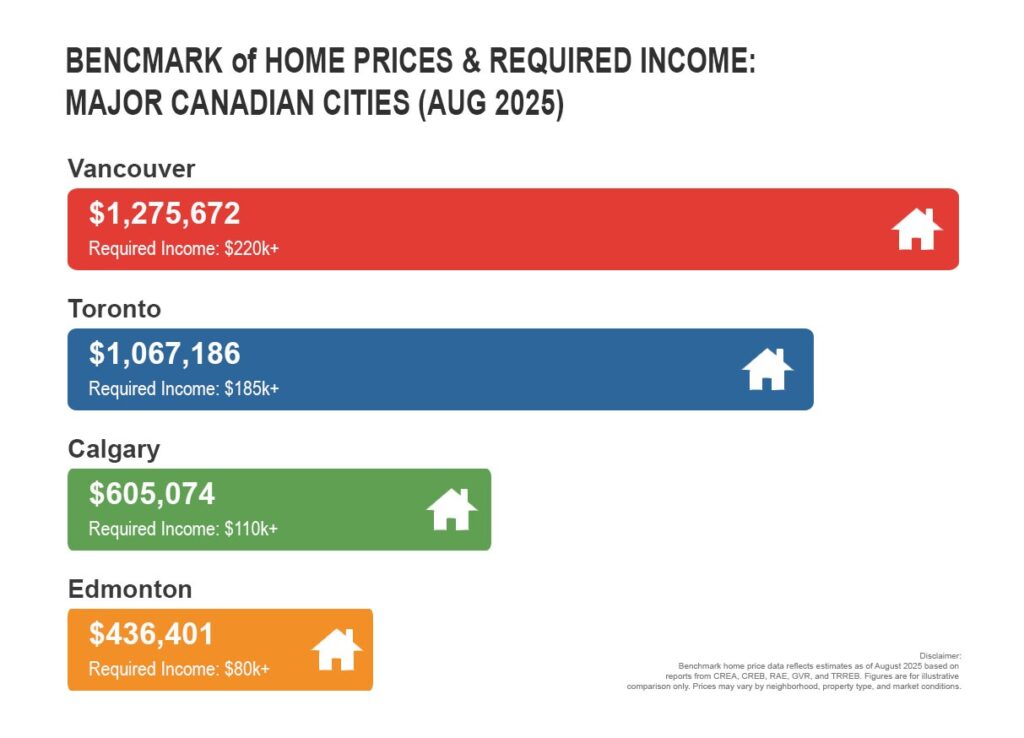

- Housing: The affordability gap remains the key driver.

- Benchmark Home Price (Aug 2025): Calgary: $605,074 | Edmonton: $436,401

- Benchmark Home Price (Aug 2025): GVA: $1,275,672 | GTA: $1,067,186

- Key Advantage: No Provincial Sales Tax (PST), 8% corporate tax rate.

1.5 How to Use This Guide

This guide is structured to be read in full or used as a reference. Sections 3-7 detail the “why” of the move (affordability, jobs, cost of living). Sections 8-11 analyze the consequences and risks (housing supply, healthcare strain, investment opportunities). Section 12 provides a practical starting point for those ready to make the leap. All data is based on the latest available reports from Statistics Canada, CMHC, provincial real estate boards, and government economic forecasts as of late 2025.

2. Interprovincial Migration: The Big Picture

2.1 What “Interprovincial Net Migration” Means

Interprovincial migration is the movement of people from one Canadian province or territory to another. Net migration is the simple calculation of in-migrants (people moving in) minus out-migrants (people moving out). A positive number means a “net gain,” while a negative number means a “net loss.” For years (approx. 2016-2019), Alberta experienced a net loss. Today, it has the highest net gain in the country.

2.2 10-Year Trendlines: Alberta vs. B.C. & Ontario

The 10-year trend shows a dramatic reversal. Following the 2015-2016 energy price crash, Alberta saw a sustained net outflow, with many moving to B.C. and Ontario for tech and finance jobs. Around 2021-2022, this trend slammed into reverse. B.C. and Ontario, which had long been net gainers, began to see a net outflow to other provinces for the first time in years. Alberta became the primary recipient. In 2023-2024, this flow reached a peak not seen in decades, with Alberta gaining over 12,000 net new residents from other provinces in a single quarter.

2.3 2025–2026: What’s Different About This Cycle

While still exceptionally strong, the trend has cooled from its 2024 peak. Alberta’s Q2 2025 net interprovincial gain was 6,187—a significant number, but a decrease from the super-heated levels of the year prior. This cycle is different for two reasons:

- The “Push” is Structural: The primary driver is not just a high oil price, but a structural and seemingly permanent housing affordability crisis in the GVA/GTA.

- The “Pull” is Diverse: Alberta’s economy, while still anchored by energy, is more diversified. The pull comes from construction, technology, logistics, and healthcare sectors, all demanding workers.

2.4 Who’s Moving? (Age, Family Status, Education, Occupation)

Data shows the move is being led by two key demographics:

- Young Families (30-44): This group, often with young children, is “cashing out” of modest condos or townhomes in B.C./Ontario to buy larger, detached family homes in Alberta.

- Young Workers (25-34): This cohort, seeing homeownership as impossible in their home provinces, is moving to Alberta to build a career and a life, often in tech, trades, or professional services.

2.5 Where They’re Coming From: Metro Vancouver & GTA Sub-flows

The migration is not just from downtown Toronto or Vancouver. The largest outflows are from the surrounding suburbs where families traditionally looked for affordability—places like Surrey and Langley in B.C., and Brampton, Mississauga, and Durham Region in Ontario. These are the areas where affordability has evaporated most completely.

2.6 Where They Land in Alberta: Calgary, Edmonton, Mid-Sized Cities

The primary destinations are Alberta’s two major urban centres and their surrounding “commuter” towns, which are now some of the fastest-growing municipalities in Canada.

- Calgary & Region: Airdrie, Cochrane, Okotoks

- Edmonton & Region: St. Albert, Spruce Grove, Sherwood Park, Beaumont

3. Push–Pull Mechanics: Why People Leave Vancouver/Toronto and Choose Alberta

3.1 Housing Economics

This is the single most important factor. The financial gap is no longer a gap; it is a chasm.

- 3.1.1 Purchase Affordability: Based on August 2025 data, a benchmark home in Vancouver is 2.1x the price of one in Calgary and 2.9x the price of one in Edmonton. The income required to qualify for a mortgage on a benchmark home in the GVA/GTA is well over $220,000, while in Calgary it is closer to $120,000 and in Edmonton, under $100,000.

- 3.1.2 Rent Levels: For those not ready to buy, the savings are immediate. Average 2025 rent for a 1-bedroom in Vancouver (~$2,800) or Toronto (~$2,500) is $1,000 to $1,300 more per month than a similar unit in Edmonton (~$1,450) or Calgary (~$1,900). This is an annual saving of $12,000-$15,000.

- 3.1.3 New Supply Pipelines: Alberta is building. Year-to-date in September 2025, housing starts in Alberta are up 20.6%. In stark contrast, Ontario’s are down 17.5% and B.C.’s are down 1.3%. Newcomers see a province that is actively building supply, versus provinces where supply is stagnant.

3.2 Jobs & Wages

- 3.2.1 Unemployment & Vacancy: The “pull” is Alberta’s high demand for labour. While unemployment rates are elevated because of the population surge, the province still has high job vacancy rates in key sectors.

- 3.2.2 Wage Differentials: Alberta continues to have the highest median household income in Canada. While wages for some occupations (like tech) may be higher in Toronto, the disposable income after housing is vastly greater in Alberta. For skilled trades, wages are often higher in Alberta outright.

- 3.2.3 Sector Demand: The job market is not just oil and gas. The largest demand is in:

- Health Care & Social Assistance

- Construction & Skilled Trades (to build new housing)

- Professional, Scientific & Technical Services

- Transportation & Warehousing (Calgary and Edmonton are major inland ports)

3.3 Taxes & Cost of Living

- 3.3.1 Alberta’s No-PST Advantage: This is an immediate 7% (vs. B.C.) or 8% (vs. Ontario) “raise” on all goods and many services. For a family, this translates to thousands in savings per year on everything from cars and furniture to restaurant meals.

- 3.3.2 Personal Income Tax: Alberta has a simple, low flat tax rate at lower income levels and competitive brackets at higher levels, making it generally favourable.

- 3.3.3 Everyday Price Basket: Groceries, utilities, and auto insurance are generally more affordable than in B.C. or Ontario. Childcare costs are also significantly lower, with Alberta’s $15/day plan saving families thousands per month compared to market rates in Toronto or Vancouver.

3.4 Lifestyle & Quality of Life

- 3.4.1 Commute Times: While growing, average commute times in Calgary and Edmonton remain significantly shorter than in the GVA or GTA.

- 3.4.2 Recreation Access: This is a major non-financial pull. Calgary’s proximity to Banff and the Rocky Mountains (under 90 minutes) is a world-class amenity. Edmonton’s sprawling North Saskatchewan River Valley provides a massive urban park system.

3.5 Business Climate

- 3.5.1 Corporate Tax & Costs: For business owners, the advantage is clear: an 8% general corporate tax rate (Canada’s lowest), no payroll tax, no PST, and more affordable commercial and industrial real estate.

- 3.5.2 Talent Availability: Businesses are moving to Alberta to access the very talent pool that is migrating there—a young, educated, and growing workforce that can be hired at a competitive all-in cost.

4. City-by-City: Alberta Landing Spots Compared

4.1 Calgary

- Economy: The corporate and financial heart of the province. Traditionally “white-collar,” it’s the hub for energy, finance, and engineering, with a rapidly growing tech and fintech sector.

- Housing: More expensive than Edmonton. The benchmark price of $605k reflects strong demand and low inventory.

- Neighbourhoods: Varies from dense inner-city (Beltline, Kensington) to sprawling new-build family suburbs (Mahogany, Evanston).

- Transit: C-Train (LRT) system, with the new Green Line under construction.

- Lifestyle: Faster-paced, younger vibe, and defined by its proximity to the mountains.

4.2 Edmonton

- Economy: The provincial capital, anchored by stable, large-scale employers in government, education (University of Alberta), and healthcare (Alberta Health Services). It is also a major “blue-collar” industrial and petrochemical hub.

- Housing: The most affordable large city in Alberta (benchmark $436k). Offers exceptional value for detached homes.

- Arts & Culture: Known as “Festival City” for its year-round events (Fringe, Folk Fest). Strong arts and theatre scene.

- Transit: A growing LRT network, including the recently opened Valley Line.

4.3 Mid-Sized Cities & Regional Centres

- Red Deer: A critical logistics and distribution hub located exactly between Calgary and Edmonton.

- Lethbridge: Southern Alberta’s hub, with an economy based on agriculture, agri-food processing, and education.

- Grande Prairie: The economic engine of the northwest, driven by energy (Montney Shale) and forestry.

- Fort McMurray: The heart of the oil sands. Offers exceptionally high incomes for specialized trades and operations.

4.4 Suburban & Exurban Options

These towns are absorbing a massive share of the interprovincial migration, offering more space and affordability than the major cities they border.

- Calgary Region: Airdrie, Cochrane, Okotoks

- Edmonton Region: St. Albert, Spruce Grove, Sherwood Park

4.5 Rural & Small-Town Migration

A smaller but significant trend involves remote workers and entrepreneurs moving to towns like Canmore (stunningly beautiful, but very expensive) or Drumheller, seeking a quieter lifestyle with lower costs.

5. Housing Deep Dive: Can Supply Keep Up?

5.1 Starts, Completions, and Vacancy: 2019–2026

The data is clear: Alberta is building, but it’s struggling to keep up with demand.

- Housing Starts: Up 20.6% year-to-date in 2025.

- Completions: Lagging starts, meaning many projects are under construction.

- Vacancy: CMHC’s 2025 reports show rental vacancy rates have plummeted to crisis levels in many cities (e.g., around 1.4% in Calgary), driving up rent prices.

5.2 Ownership: Price-to-Income & Mortgage Qualification

While affordability is eroding, it remains in a different universe from B.C./Ontario. A household earning $120,000 can comfortably qualify for the benchmark detached home in Calgary; in Edmonton, an income of $95,000 is sufficient. In the GVA/GTA, that same household is priced out of all but the smallest condos.

5.3 Rentals: Purpose-Built vs. Secondary Market

The rental market is where the strain is most acute. With vacancy rates so low, bidding wars for rentals are becoming common in Calgary, a phenomenon previously unheard of outside Vancouver or Toronto. This puts immense pressure on newcomers.

5.4 Construction Capacity Constraints

Alberta cannot simply build its way out of this overnight. The industry faces three major constraints:

- Labour: A severe shortage of skilled trades (framers, electricians, plumbers).

- Materials: Ongoing supply-chain issues and cost inflation.

- Financing: High interest rates in 2024-2025 make it more expensive for developers to start new projects.

5.5 Policy Levers & Pipelines (Zoning, Incentives)

Cities are responding. Calgary made headlines by rezoning the entire city to allow for more gentle density (R-CG zoning), making it easier to build duplexes and townhomes. Edmonton has also been a leader in infill development.

5.6 Outlook: 2026–2028 Scenarios

The “affordability gap” between Alberta and the GVA/GTA will almost certainly narrow. Alberta’s home prices will continue to rise faster than the national average, while prices in B.C./Ontario may stagnate. However, the gap is so large that it will take many years to close. Alberta will remain the most affordable “big province” for the foreseeable future.

6. Labour Market & Industry Outlook

6.1 Province-wide Employment & Wage Trends

The Alberta paradox of 2025-2026: The economy is booming, but so is the labour force. This creates a “disconnect” where the number of jobs is growing at a record pace, but the unemployment rate is also rising as the province struggles to absorb the tens of thousands of newcomers seeking work.

6.2 Sector Spotlights

- 6.2.1 Energy & Petrochemicals: The sector is stable and profitable, with new life from the Trans Mountain Pipeline expansion (getting oil to new markets) and massive investment in hydrogen and Carbon Capture, Utilization, and Storage (CCUS).

- 6.2.2 Construction & Skilled Trades: The most in-demand sector. There is a desperate need for all trades to build the homes, schools, and hospitals the growing population requires.

- 6.2.3 Technology & Professional Services: A fast-growing “dark horse.” Calgary has become a hub for fintech and SaaS companies, while Edmonton is a leader in Artificial Intelligence and machine learning (thanks to the U of A).

- 6.2.4 Healthcare & Public Services: In a state of chronic, critical demand. The province is aggressively recruiting nurses, doctors, and other healthcare professionals.

- 6.2.5 Transportation, Logistics & Agriculture: Edmonton and Calgary are major inland ports and distribution hubs for all of Western Canada. Agriculture and agri-food processing remain pillars of the economy.

6.3 Credentials & Licensing

This is a critical hurdle for movers. Alberta has streamlined processes for recognizing credentials for many trades and professions, but newcomers (especially in healthcare, engineering, and law) must plan months in advance to get their licenses transferred.

6.4 Job-Search Channels & Employer Expectations

The market is dynamic. While some employers are desperate, many are also overwhelmed with applications from out-of-province candidates. A “boots-on-the-ground” approach, or at least a local Alberta address and phone number, is often cited as a key to success.

7. Cost of Living: Alberta vs. Vancouver/Toronto

7.1 Housing (Own vs. Rent)

As detailed in Section 3, this is the biggest saving, often $1,000-$2,000 per month.

7.2 Transportation (Insurance, Fuel, Transit)

Auto insurance is generally cheaper in Alberta than in B.C. (which uses a public model) or Ontario (notoriously high rates in the GTA). Provincial gas taxes are also lower.

7.3 Childcare & Education

Alberta’s participation in the federal $10/day childcare plan (currently averaging ~$15/day) is a game-changer for families, saving them $1,000+ per child per month compared to 2023 rates in Toronto or Vancouver.

7.4 Groceries & Utilities (CPI Sub-Indexes)

Groceries are comparable, but the lack of PST on food (in B.C.) and all goods (in Ontario) makes a difference. Utilities (electricity and natural gas) are deregulated and can be volatile, but are generally competitive.

7.5 Health & Benefits (Public Coverage)

Public health coverage (AHCIP) is robust, but the access is the problem (see Section 8.3). Many employers offer strong private benefit plans.

7.7 Worked Examples: Three Household Personas

- Persona 1: Single Tech Worker (30)

- Leaves: 1-bed condo rent in Toronto ($2,600/mo).

- Moves to: 1-bed+den rent in Calgary’s Beltline ($1,900/mo).

- Result: Saves $8,400/year on rent. Saves ~$1,500/year from no PST. Disposable income increases significantly, allowing for savings to buy a first condo within 2-3 years.

- Persona 2: Trades Family (38, 36, 2 kids)

- Leaves: 3-bed townhouse in Surrey, B.C. (Value: $1.2M).

- Moves to: 4-bed detached home in Airdrie, AB (Cost: $700,000).

- Result: Sells B.C. home, buys Alberta home with a tiny mortgage or none at all. Childcare costs drop from $2,400/mo to ~$660/mo. Husband’s wage as an electrician is comparable or higher. Their entire financial picture is transformed.

- Persona 3: Newcomer Student Couple

- Leaves: Basement apartment in Brampton, ON ($1,900/mo).

- Moves to: 2-bed apartment in Edmonton ($1,700/mo) to attend U of A.

- Result: Lower rent, lower tuition, and a clearer pathway to provincial nomination for permanent residency via the Alberta Advantage Immigration Program (AAIP).

8. Retention Question: Will Alberta Keep Its Newcomers?

8.1 Historic “Boom-Bust” & Lessons Learned

The critical question is: is this another “boom-bust” cycle? Skeptics point to the 2016 outflow as proof that when the economy turns, people leave. However, the structural nature of the “push” from B.C./Ontario suggests this cycle is different.

8.2 Housing Affordability Durability vs. Demand Growth

The #1 retention factor—affordability—is already being eroded by the move itself. The province’s ability to keep building and managing price growth is the key variable.

8.3 Transit, Schools, Healthcare Capacity & Wait Times

This is the single greatest risk to retention. The 2025-2026 data is alarming.

- Healthcare: Recent (late 2025) reports show provincial waitlists have swelled to over 500,000 (including ~82,000 for surgery and ~174,000 for diagnostics).

- Family Doctors: An estimated 1-in-5 Albertans does not have a family doctor.

- ER Wait Times: Long wait times are a chronic complaint.

- Funding: The 2025 provincial budget was criticized for failing to increase health and education funding in line with the massive population growth.

Newcomers arriving for a better quality of life may not stay if they cannot access a doctor or get their kids into a local school.

8.4 Community Integration & Safety

Cities are scrambling to grow community services. Crime rates, particularly in urban centres, are a concern, though often comparable to other large Canadian cities.

8.5 Climate & Insurance Risk

Wildfires (as seen in 2023-2024), hail (a major Calgary risk), and flooding are significant climate risks that lead to high insurance premiums.

8.6 What Would Cause Re-Outflow?

- A total collapse in the energy sector (unlikely, but possible).

- A failure to fix the healthcare and education crises (the most likely driver).

- Alberta’s housing affordability gap closing completely.

9. For Newcomers & Immigrants: Pathways and Practicalities

9.1 Immigration Pathways (Federal Express Entry overview, AAIP streams)

Alberta is actively using the Alberta Advantage Immigration Program (AAIP) to nominate permanent residents. It’s one of the most active PNPs in Canada, with dedicated streams for workers in high-demand fields like:

- Healthcare

- Technology

- Construction

- Agriculture

This provides a clear pathway from a work permit to PR for those with the right skills.

9.2 Housing Search Playbook

Start 3-4 months before your move. The rental market is tight. Be prepared with a letter of employment, references, and a deposit. Many newcomers secure an Airbnb for their first month to conduct an in-person search.

9.3 Schools & Childcare Enrollment

Get on childcare waitlists immediately. They can be months or even a year long. Register for your local public or Catholic school as soon as you have a lease or purchase agreement.

9.4 Driver’s Licence, Insurance, Healthcare Registration

You must apply for an Alberta Health Care Insurance Plan (AHCIP) card upon arrival. You also have 90 days to switch your driver’s license and register/insure your vehicle in the province.

9.5 Building Credit History & Banking

For international newcomers, establishing a Canadian credit history is a top priority. Start with a secured credit card from a major bank.

10. For Investors & Business Owners

(This section is particularly relevant given your provincial incorporation in Alberta.)

10.1 Incorporating in Alberta (Entity Types, Costs)

As you know, incorporating in Alberta is a straightforward process, similar to other provinces. The real advantages come after incorporation.

10.2 Corporate Tax, Payroll, GST & Compliance Basics

This is Alberta’s single greatest “pull” for business.

- Corporate Tax: A general rate of 8%. This is the lowest in Canada, significantly less than B.C. (12%) or Ontario (11.5%).

- Provincial Sales Tax (PST): None. This is a massive operational and capital advantage. It means every purchase of office furniture, computer equipment, machinery, and company vehicles is 7-8% cheaper than it would be in B.C. or Ontario.

- Payroll Tax: None. Unlike B.C. (Employer Health Tax) and Ontario (EHT), Alberta does not have a separate payroll tax for health. This directly reduces the cost of hiring.

10.3 Hiring in Alberta (Labour Availability, Wage Benchmarks)

You are setting up in a province with a rapidly expanding, young, and educated labour pool. While wages are high, the lower all-in cost (no payroll tax) and the lower cost of living for your employees make it an attractive place to hire and retain talent.

10.4 Industrial & Commercial Real Estate Overview

Lease rates and purchase prices for industrial and office space remain significantly more affordable than in the GVA or GTA, lowering your fixed overhead costs.

10.5 Incentives & Grants Landscape

The province offers various incentives, particularly for businesses in technology (via Alberta Innovates), agriculture, and energy diversification (hydrogen, CCUS).

10.6 Case Studies: B.C./Ontario Firms Expanding to Alberta

A common 2024-2026 strategy is the “Alberta Hub.” A B.C. or Ontario tech company, struggling to retain employees who can’t afford to live in Vancouver or Toronto, opens a “satellite” office in Calgary. This allows them to access a skilled talent pool and offer their employees a higher quality of life and a path to homeownership, all while lowering their own corporate tax and operating costs.

11. Risks, Unknowns & Scenario Planning (2025–2028)

11.1 Interest Rate Paths & Housing Finance

If high interest rates persist, it will cool both the migration trend and the construction boom, as fewer people can afford to move or qualify for mortgages.

11.2 Energy Price Bands & Provincial Revenues

The provincial budget is still heavily tied to energy royalties. A major crash in WTI oil prices (e.g., below $50/barrel) would put a significant strain on provincial finances, threatening its ability to fund services.

11.3 Construction Capacity & Supply-Chain Constraints

The primary bottleneck. If Alberta can’t build homes, schools, and hospitals fast enough, the “affordability advantage” will vanish and the “quality of life” (healthcare, education) will deteriorate, risking a re-outflow.

11.4 Federal/Provincial Policy Shifts

Changes to immigration levels, the federal childcare program, or provincial tax policy could all alter the equation.

11.5 Best-, Base-, and Downside Scenarios

- Best Case (2026-2028): Energy prices remain stable, interest rates ease, construction booms, and the provincial government successfully invests in health/education. Alberta solidifies its status as an economic and demographic hub.

- Base Case (Most Likely): Migration continues at a strong (but slower) pace. Housing affordability erodes but the gap remains. Healthcare and schools strain badly, becoming the dominant political issue.

- Downside Case: A global recession tanks oil prices, and high interest rates stall construction. Migration slows to a trickle, and Alberta’s job market stagnates.

12. Relocation Checklists & Tools

12.1 60-Day Move Timeline (Sample)

- 60 Days Out: Give notice to landlord. Book moving company (book early). Start researching neighbourhoods.

- 45 Days Out: Get on childcare waitlists. Start job-search process. Request professional credential transfers.

- 30 Days Out: Book temporary accommodation (e.g., Airbnb) for your first 1-2 weeks. Set up mail forwarding.

- 15 Days Out: Arrange to cancel B.C./Ontario utilities. Set up Alberta utilities/internet.

- Arrival Week: Apply for AHCIP. Get Alberta driver’s license. Open local bank account.

12.2 Budget Template (Key Items)

- Moving Costs (Truck, Gas, Movers)

- Temporary Accommodation

- Rental Deposit + First Month’s Rent

- Utility Hookup Fees

- Vehicle Registration & Insurance

- Winter Tires (a non-negotiable)

- Emergency Fund (3-6 months’ expenses)

12.3 City Fit Matrix

| Factor | Calgary | Edmonton |

| Affordability | Good | Excellent |

| Job Market | White-Collar (Energy, Finance) | Blue-Collar (Industrial, Govt) |

| Lifestyle | Mountains, Faster-Paced | River Valley, Arts & Festivals |

| Climate | Milder, “Chinooks” | Colder, Sunnier |

13. FAQs (SEO)

13.1 “Is Alberta still cheaper than Vancouver/Toronto in 2025–2026?”

Yes, significantly. While Alberta’s housing prices are rising, the gap remains vast. A benchmark home is 2-3x cheaper, and rent is often $1,000+ less per month. The lack of a PST provides additional savings.

13.2 “What salaries do I need to buy in Calgary/Edmonton?”

As of late 2025, you need a household income of approximately $95,000 to buy a benchmark home in Edmonton and $120,000 in Calgary. In the GVA/GTA, this figure is over $220,000.

13.3 “Will housing prices jump if everyone moves there?”

They already are. Calgary, in particular, has seen some of the fastest price appreciation in Canada. This is the main risk to the affordability advantage.

13.4 “What jobs are most in demand right now?”

Healthcare (nurses, doctors), Skilled Trades (all types), and Technology (software developers, IT project managers).

13.5 “Is Alberta safe? How’s the healthcare?”

Major cities have crime rates comparable to other large Canadian centres. The real issue is healthcare access. Be prepared for long wait times for specialists and emergency rooms, and a difficult search for a family doctor. This is the province’s most significant challenge.

13.6 “Can I keep my remote job if I move?”

Yes, and many people do. This is a popular strategy. Just be aware of tax implications: you will file as an Alberta resident and pay Alberta’s provincial income tax rates, not B.C.’s or Ontario’s.

13.7 “What about winters and car insurance?”

Yes, the winters are cold, but often sunny. You must invest in high-quality winter tires. Auto insurance is typically cheaper than in B.C. or the GTA.

14. Methodology & Data Notes

This article is based on publicly available data from Statistics Canada (Tables 17-10-0140-01, 17-10-0135-01), the Alberta Economic Dashboard, CMHC (Housing Starts, Rental Market Reports), and provincial real estate boards (CREA, CREB, RAE, TRREB, GVR). All figures are based on the latest available data as of Q3/Q4 2025.

15. Conclusion

15.1 The Bottom Line for Movers

The “Great Alberta Exodus Reversed” is a rational response to a national affordability crisis. The promise of Alberta in 2026 is the promise of a life that has become unattainable for many in the GVA and GTA: a good-paying job, the possibility of homeownership, and a financially secure future. But the “2023 Alberta” of rock-bottom prices is gone. Newcomers are arriving in a province that is booming but also straining under its own success. The opportunity is real, but it comes with new challenges—namely, stressed public services.

15.2 Strategic Considerations for Investors & Employers

For investors and business owners, Alberta’s fundamentals are arguably the strongest in Canada: powerful population growth, a business-friendly tax regime, and a growing, skilled labour pool. The primary risks are not economic but infrastructural. The greatest opportunities will be in businesses that help solve the province’s growing pains: construction, healthcare, education, and technology.

15.3 What to Watch Next (Leading Indicators)

To track this trend, watch these three numbers:

- StatCan Net Migration Data (Quarterly): Is the net inflow slowing, stabilizing, or re-accelerating?

- Alberta Housing Starts (Monthly): Is construction keeping pace with population growth?

- Alberta Health Wait Times (Monthly): Is the province successfully managing the strain on public services?

The answers to these questions will determine the next chapter of Alberta’s remarkable story.

16. Sources & Data Links

This article is based on publicly available data from the following official sources.

Population, Migration & Demographics

- Estimates of the components of interprovincial migration, quarterly (Table 17-10-0140-01): https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=17100140-01 (Statistics Canada)

- Estimates of interprovincial migrants by province or territory of origin and destination, quarterly (Table 17-10-0135-01): https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=17100135-01 (Statistics Canada)

- Population estimates, quarterly (Table 17-10-0009-01): https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=17100009-01 (Statistics Canada)

- 2021 Census of Population – Census Profiles: https://www12.statcan.gc.ca/census-recensement/2021/dp-pd/prof/index.cfm?Lang=E (Statistics Canada)

- Alberta’s Population Report (Quarterly): https://www.alberta.ca/alberta-demographics (Alberta Treasury Board and Finance)

Labour Market & Wages

- Labour force characteristics by province, monthly, seasonally adjusted (Table 14-10-0287-01): https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=14100287-01 (Statistics Canada)

- Job vacancies, payroll employees, and job vacancy rate by industry sector, monthly (Table 14-10-0372-01): https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=14100372-01 (Statistics Canada)

- Job market forecasts (Alberta.ca): https://www.alberta.ca/job-market-forecasts (Government of Alberta)

Housing & Construction

- CMHC Housing Market Data and Research: https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/housing-market-data (CMHC)

- CREA Housing Market Stats: https://www.crea.ca/housing-market-stats/ (Canadian Real Estate Association)

- CREB Market Statistics: https://www.creb.com/market-statistics/ (Calgary Real Estate Board)

- RAE Market Stats: https://www.realtorsofedmonton.com/Market-Stats (REALTORS® Association of Edmonton)

- TRREB Market Watch: https://trreb.ca/market-data/market-watch (Toronto Regional Real Estate Board)

- GVR Market Watch: https://www.gvr.ca/market-watch (Real Estate Board of Greater Vancouver)

Prices & Cost of Living

- Consumer Price Index, monthly, not seasonally adjusted (Table 18-10-0004-01): https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=18100004-01 (Statistics Canada)

- Alberta Automobile Insurance Rate Board (AIRB): https://albertaairb.ca/ (Official regulator for auto insurance in Alberta)

- Alberta Child Care Affordability: https://www.alberta.ca/child-care-affordability (Government of Alberta)

Taxes & Public Finance

- Alberta taxes and levies overview: https://www.alberta.ca/taxes-levies-overview (Government of Alberta)

- Budget 2025: https://www.alberta.ca/budget (Government of Alberta)

Industry & Investment

- AER Data & Information: https://www.aer.ca/providing-information/data-and-reports (Alberta Energy Regulator)

- Invest Alberta: https://investalberta.ca/ (Provincial agency focused on investment attraction)

- Alberta Innovates: https://albertainnovates.ca/ (Primary provincial agency for innovation and R&D funding)

Health, Education, Safety & Environment

- AHS Estimated Emergency Department Wait Times: https://www.albertahealthservices.ca/waittimes/waittimes.aspx (Alberta Health Services)

- Health care services covered in Alberta (AHCIP): https://www.alberta.ca/ahcip-what-is-covered (Government of Alberta)

- Crime severity index and weighted clearance rates (Table 35-10-0026-01): https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=35100026-01 (Statistics Canada)

Newcomer & Immigration Pathways

- Alberta Advantage Immigration Program (AAIP) application streams: https://www.alberta.ca/aaip-application-streams (Government of Alberta)

Municipal & Regional

- The City of Calgary’s Housing Strategy: https://www.calgary.ca/communities/housing-in-calgary/housing-strategy.html (Official “Home is Here” (2024-2030) strategy)

- Green Line LRT: https://www.calgary.ca/green-line.html (Official project page for Calgary’s largest infrastructure project)

- The City Plan (Edmonton): https://www.edmonton.ca/city_government/urban_planning_and_design/the-city-plan (Edmonton’s primary municipal development plan)

LRT Expansion (Edmonton):https://www.edmonton.ca/projects_plans/transit/lrt-expansion (Main hub for all of Edmonton’s LRT projects)