1. Introduction & Executive Overview

Alberta’s economy is defined by its deep connection to the global crude oil market, serving as Canada’s largest producer. This link means global commodity price fluctuations directly impact provincial finances, energy investment, and, critically, the day-to-day budgets of residents.

Why 2025 oil prices matter: The year 2025 marks a crucial economic pivot. Oil price moderation is weakening the provincial government’s resource revenues ($1.4 billion shortfall in Q1 2025), but a historically massive 2.5% population influx is fueling resilient growth in construction, retail, and services. The resulting economic narrative is complex, characterized by both strong job creation and budgetary caution.

Current Pricing Context: Q3–Q4 2025 Snapshot

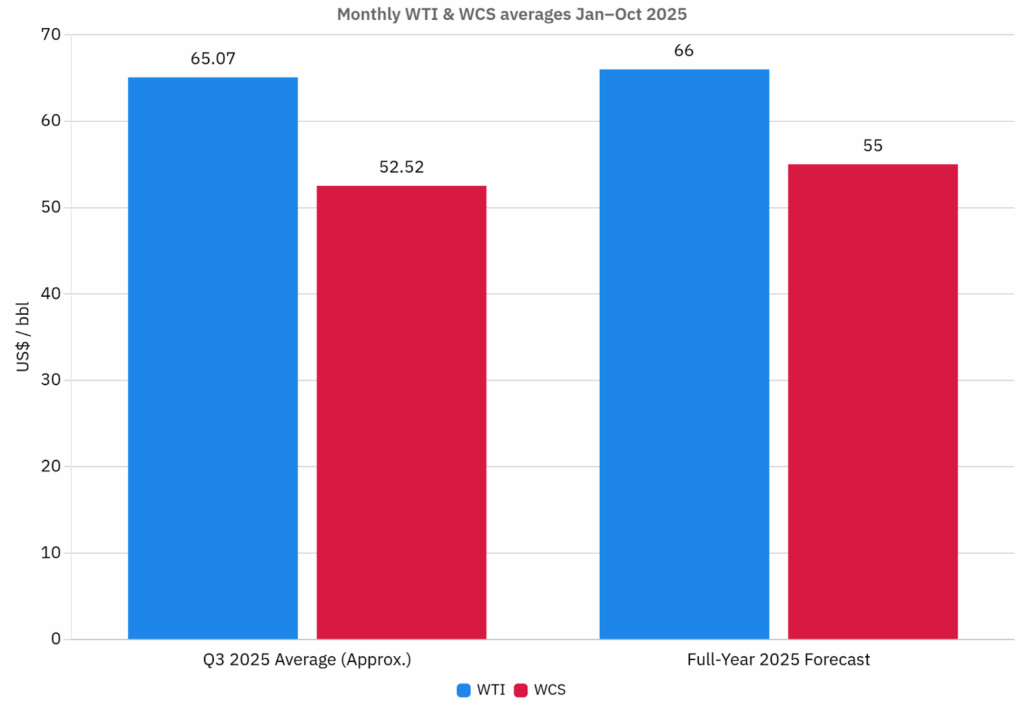

Oil prices moderated in 2025 due to strong non-OPEC+ supply. Alberta’s revenue is determined by Western Canadian Select (WCS), which trades at a discount (the differential) to the global benchmark, West Texas Intermediate (WTI).

| Benchmark | Q3 2025 Average (Approx.) | Full-Year 2025 Forecast |

| West Texas Intermediate (WTI) | US$65.07 / bbl | US$66.00 / bbl |

| Western Canadian Select (WCS) | US$52.52 / bbl | US$55.00 / bbl |

Lower oil = cheaper gas but lower government revenue

The core impact on the Albertan wallet is a trade-off: lower fuel costs provide minor relief, but this is overwhelmed by persistent structural inflation in housing and groceries driven by record population growth.

2. Alberta’s Oil-Driven Economic Structure

Alberta produces over 80% of Canada’s oil, holding vast oil sands reserves. The province’s economic DNA is highly sensitive to commodity cycles, with the energy sector historically contributing 15% to 20% of the provincial GDP. The provincial government’s budget remains heavily reliant on royalties from these resources. The low-to-moderate WCS price environment in 2025 means that new, high-cost oil sands expansion is suppressed, shifting the energy sector’s focus to efficiency, technology, and share buybacks rather than broad capital expenditure (capex) growth.

3. How Oil Prices Shape Personal Finances

3.1 Employment and Income

Alberta’s labour market in late 2025 is paradoxical: it shows robust net job gains driven by population expansion, yet maintains a significantly elevated unemployment rate (7.8% in September 2025). The market is struggling to absorb the sheer volume of newcomers.

- Hiring Trends: Major energy hiring focuses on specialized roles (data science, clean-tech, optimization engineers). Job creation for general labour is concentrated in population-driven sectors like construction, manufacturing, and retail.

- Wage Competitiveness: Alberta’s high average weekly earnings, sustained by specialized energy and utility roles, remain a key advantage, especially when combined with the lack of Provincial Sales Tax (PST).

3.2 Cost of Living Implications

- Gasoline: The moderation of WCS prices and the provincial carbon levy removal led to a 4.1% year-over-year decline in gasoline prices in September 2025, offering tangible relief at the pump.

- Housing: The high cost of shelter is the primary pressure point. The purchase market for high-end detached homes is softening (Calgary benchmark fell 4% YoY to $572,800) due to high interest rates, but the rental market remains critically tight and inflated due to population influx. Edmonton’s average rent slightly cooled to $1,573, but affordability pressure for new arrivals is intense.

- Taxation Benefits: Alberta maintains a unique competitive edge as the only Canadian province without a PST, providing greater take-home purchasing power than British Columbia or Ontario.

3.3 Practical Budget Scenarios

All budgets must balance the tax advantage against high shelter costs:

- Individual Worker: Benefits from high salary potential and no PST. Primary challenge is securing employment amidst the 7.8% unemployment environment and managing the high initial cost of rent.

- Young Family: Benefits from lower overall income tax (new 8% rate for incomes under $60,000) and lower single-family home prices compared to Vancouver/Toronto. Budget strain comes from grocery costs (4.0% YoY rise) and high utility/insurance costs (11.9% YoY rise in home insurance).

4. Government Services and Fiscal Stability

Royalty revenues and provincial budget outcomes in 2025

The resource royalty system is highly sensitive to WCS prices. The moderation near $55/bbl resulted in a $1.4 billion resource revenue shortfall against projections in Q1 2025. This fiscal constraint limits the government’s ability to aggressively fund public services to meet the demands of the 5.0 million person population.

- Impacts on Services: The revenue shortfall creates pressure points in healthcare funding and education, where rapidly expanding student populations require significant capital investment in new schools. Infrastructure spending is being maintained as a counter-cyclical economic stimulus.

Alberta Heritage Fund: value, use, debate

The Alberta Heritage Savings Trust Fund (AHSTF) was established to save a portion of resource revenue. Its fair value as of June 30, 2025, was $27.6 billion, having received a $2.8 billion surplus deposit. The fund is aiming for $250 billion by 2050 to stabilize future budgets, but this goal highlights the historical failure to save adequately during previous oil booms.

5. Real Estate and Migration Patterns

Relationship between oil cycles and home prices

The traditional correlation between high oil prices and an overheating housing market has been disrupted. In 2025, population growth and high interest rates are the main drivers. The massive influx of new residents maintains demand pressure, particularly at the entry level, even as high interest rates slow the high-end purchase market.

Rent vs. Buy Considerations for New Arrivals

Given the high interest rate environment (2.50% Bank of Canada rate) and the labour market’s absorption challenge, renting for the first 6–12 months is strongly advised for new arrivals. Renting provides flexibility and avoids locking into high mortgage costs while employment is stabilized. Rental properties, despite the high cost, offer robust cash flow for investors due to critically low vacancy rates.

6. Business Climate and Economic Diversification

Corporate tax advantages and labour market realities

Alberta maintains a supportive corporate tax environment, making it attractive to business owners (including foreign-incorporated entities like the reader’s). The large and growing 5.0 million person consumer base creates vast opportunity. However, businesses face cautious consumer spending (shift to necessity-driven expenditures) and elevated operational costs due to national inflation.

Industry opportunities

- Energy services: Focused on optimization, maintenance, and short-cycle projects, leveraging AI and technology.

- Construction and development: A boom sector driven by housing starts and public infrastructure.

- Retail and Hospitality: Directly benefiting from the growing population and consumer demand.

- Technology: Key diversification target, with strong growth in Calgary’s fintech and agritech sectors.

Province-led transition initiatives beyond fossil fuels

The government is prioritizing diversification through targeted incentives for non-energy businesses. Long-term prosperity hinges on successfully transitioning the province’s energy expertise into low-carbon technologies like CCUS and hydrogen, though regulatory uncertainty (e.g., around TIER reforms) poses a risk to multi-billion dollar clean energy projects.

7. Investor & Business Considerations

7.1 Individuals

- Portfolio Exposure: Energy stocks should be balanced, focusing on integrated companies with strong balance sheets that prioritize capital return rather than high-risk, long-horizon growth projects.

- Real Estate: Focus on multi-family residential rental units for cash flow, as this segment benefits most from the population boom.

- CAD Currency Correlation: The Canadian dollar (CAD) retains a historical link to oil. As WTI/WCS prices moderated in 2025, the CAD often showed weakness, which international investors must account for with hedging strategies.

7.2 Business & Foreign Investors

- Market Entry Timing: Optimal timing for businesses serving the essential needs of the growing population (e.g., healthcare technology, efficient logistics, professional services) rather than those tied to speculative oil capex.

- Operational Resilience: For the Australian-based owner, focus on contracts and consumer bases that are not directly tied to the oil and gas field services spending to mitigate WCS price volatility. Leverage the corporate tax advantage while maintaining strict cash flow management against high national interest rates.

8. Outlook for 2025 and Beyond

Short-term global supply/demand drivers

Short-term forecasts suggest WTI prices will continue to moderate toward $62/bbl in Q4 2025 and decline further to $52/bbl in H1 2026. This implies continued fiscal constraint for the provincial government and greater reliance on the economic momentum generated by population growth.

Longer-term energy transition influences

The long-term goal of decarbonization fundamentally limits the prospect of another unrestrained, long-term oil boom, forcing the energy sector to specialize and automate. Alberta’s future rests on its success in transitioning its energy expertise to low-carbon technologies.

Key uncertainties and potential economic shocks

Major uncertainties include global geopolitical events affecting supply, future OPEC+ production decisions, and the risk of an economic recession tied to persistent global interest rate hikes. Domestically, the federal-provincial climate policy dynamic (TIER regulations) remains a major wild card for long-term investment.

9. Practical Guidance by Reader Type

- New Residents: Target specialized technical jobs or those in population-driven sectors. Ensure a financial buffer of 4–6 months of living expenses due to high rent and the 7.8% unemployment absorption challenge.

- Current Residents: Upskill in trades or digital literacy, as the energy sector’s labour demand is rapidly specializing. Use the relief from lower fuel costs to aggressively pay down high-interest consumer debt.

- Investors: Balance energy exposure with allocations to the logistics, manufacturing, and technology clusters. Focus on assets driven by the 5.0 million person consumer base.

- Business Owners: Focus on efficiency, maintain strict cash flow management, and diversify the customer base away from sole reliance on oil and gas capex.

10. Conclusion & Key Insights

Summary of the relationship between oil prices and daily life

The Alberta economy in 2025 is defined by a dichotomy: the Oil Price Risk (external commodity volatility, constraining public funds) versus the Population Demand Advantage (internal demographic resilience, driving job creation and housing costs).

How to make informed decisions in Alberta’s resource-linked economy

All financial decisions should balance this dichotomy. If your career or business is population-dependent (construction, retail, tech), the outlook remains strong. If it relies purely on aggressive, high-cost oil capex, caution is required. The path to long-term success in Alberta is one of diversification and resilience.

Recommendations for further information and monitoring

Monitor the Alberta Economic Dashboard for monthly WCS prices and the Labour Force Survey for the unemployment rate and job creation trends. Pay close attention to the Bank of Canada’s policy rate for future impact on all forms of financing.

External Source Links and Data Portals

This article leverages data and forecasts from the following authoritative public and private sector organizations. The links provided direct you to the main data portal or report landing page for each source, where the specific Q3-Q4 2025 reports were accessed.

Government & Official Statistics

- Statistics Canada: Labour Market, Wages, Inflation (CPI, regional)

- Alberta Treasury Board and Finance: Provincial Fiscal Status, Resource Revenue Shortfall, Population Total

- Government of Alberta/Alberta.ca: Demographic Statistics, Population Growth Rate, Migration Lead

- Alberta Energy Regulator (AER): Oil & Gas Production Data, WCS Price Forecasts

- Alberta Heritage Savings Trust Fund (AHSTF): Fund Value, Performance, Long-term Goals

Economic Forecasts & Financial Institutions

- U.S. Energy Information Administration (EIA): WTI Price Forecasts, Global Oil Inventory, Short-Term Outlook

- Bank of Canada: Policy Rate (2.50%), Interest Rate Environment, Financing Costs

- RBC Economics and TD Economics: Provincial Forecasts, Salary Lag, Fiscal Cushion Effectiveness

- The Conference Board of Canada: Skill Shifts in Energy Sector, Diversification Trajectory

Urban & Commercial Market Data

- Calgary Real Estate Board (CREB), REALTORS® Association of Edmonton (RAE): Calgary Benchmark Price, Home Price Deceleration, Market Dynamics

Rentals.ca Data: Edmonton Average Rent, Rental Market Conditions, Affordability Pressure