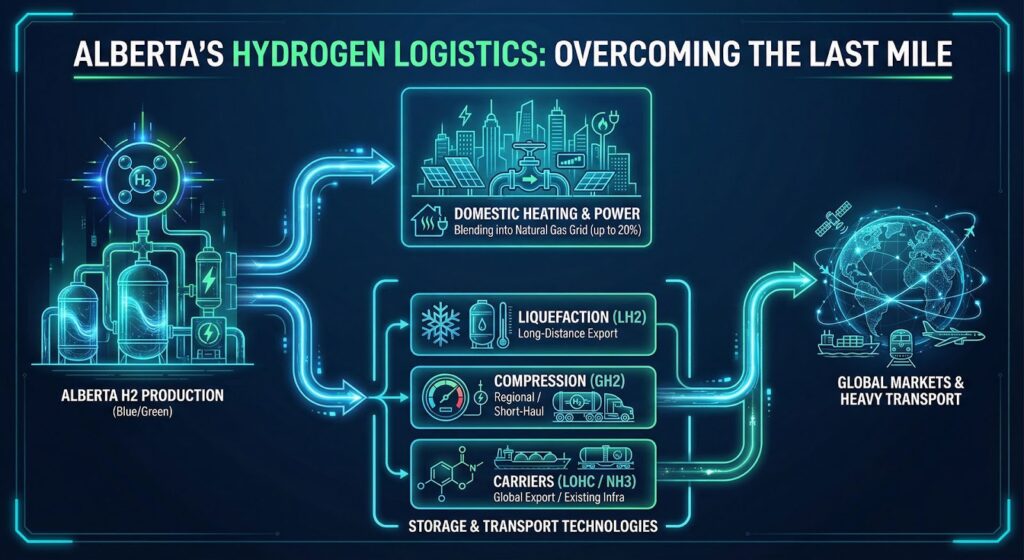

Alberta, a province synonymous with energy, stands at the precipice of a new era. With an abundance of natural gas resources and a strong commitment to decarbonization, the potential for Alberta to become a global leader in hydrogen production is immense. However, unlocking this potential hinges on overcoming a critical hurdle: the “last mile” challenge of hydrogen storage and transport. This technical deep-dive will explore the logistical bottlenecks that must be solved for Alberta to realize its ambition as a major exporter of this clean fuel, bridging the gap between technical understanding and investment opportunities.

The Trade-Off: Navigating Hydrogen Storage and Transport Technologies

Hydrogen, the simplest and most abundant element in the universe, presents unique challenges when it comes to storage and transport. Its low volumetric energy density means that a significant amount of space is required to store a usable quantity of hydrogen. This necessitates a careful evaluation of various technologies, each with its own trade-offs in terms of efficiency, safety, and cost.

1. Liquefaction: The Cryogenic Conundrum

Liquefaction involves cooling hydrogen to an extremely low temperature (-253°C or -423°F) to transform it into liquid hydrogen (LH2). This process significantly increases hydrogen’s volumetric density, making it a viable option for long-distance transport via specialized cryogenic tankers.

Advantages:

- High Energy Density: LH2 has a significantly higher energy density per unit volume compared to compressed hydrogen gas, making it attractive for large-scale, long-distance transport.

- Established Technology (for niche applications): The technology for producing and transporting LH2 is well-established in specific industrial applications, such as rocket fuel.

Disadvantages:

- Energy Intensive: The liquefaction process is highly energy-intensive, consuming approximately 30-35% of the energy content of the hydrogen itself. This significantly impacts the overall efficiency and cost-effectiveness of LH2.

- Boil-Off Losses: Due to the extremely low temperatures required, LH2 is susceptible to “boil-off,” where a portion of the liquid hydrogen evaporates during storage and transport, leading to product loss.

- High Capital Costs: The infrastructure required for liquefaction plants and cryogenic storage tanks is substantial and expensive.

- Safety Concerns: While advancements in safety protocols have been made, the handling of cryogenic liquids at such extreme temperatures still presents inherent safety challenges.

2. Compression: The Pressure Proposition

Compressing hydrogen gas to high pressures (typically 350-700 bar or 5,000-10,000 psi) is another common method for storage and transport. This increases the volumetric energy density, though not to the same extent as liquefaction. Compressed hydrogen is widely used in smaller-scale applications, such as fuel cell electric vehicles.

Advantages:

- Lower Energy Demand (than liquefaction): Compression is less energy-intensive than liquefaction, typically consuming around 10-15% of the hydrogen’s energy content.

- Mature Technology: High-pressure compression technology is well-developed and commercially available for various industrial applications.

- Flexibility: Compressed hydrogen can be stored in various tank configurations, from small cylinders to large industrial storage vessels.

Disadvantages:

- Lower Volumetric Density (than LH2): Despite compression, the volumetric energy density of compressed hydrogen gas remains significantly lower than LH2, requiring larger storage volumes for equivalent energy content.

- High Pressure Safety: Storing and transporting hydrogen at such high pressures necessitates robust and specialized containment systems, posing safety concerns related to potential leaks or ruptures.

3. Carrier Technologies: The Chemical Conversion Approach

Carrier technologies involve chemically binding hydrogen to another substance, making it easier to transport and store. Upon reaching its destination, the hydrogen is then released from the carrier. This approach offers a promising solution for long-distance, large-scale transport, particularly for export markets.

a. Liquid Organic Hydrogen Carriers (LOHCs): A Promising Avenue

LOHCs are organic compounds that can reversibly absorb and release hydrogen through chemical reactions. They act as a liquid “sponge” for hydrogen, offering an attractive solution for long-distance transport using existing liquid fuel infrastructure.

Process:

- Hydrogenation: Hydrogen is chemically reacted with the LOHC molecule (e.g., toluene to methylcyclohexane – MCH) to form a hydrogen-rich carrier. This reaction is exothermic (releases heat).

- Transport: The hydrogen-rich LOHC is then transported at ambient temperature and pressure using conventional tankers, pipelines, or rail cars, similar to how gasoline or diesel is transported.

- Dehydrogenation: At the destination, the hydrogen-rich LOHC is heated to release the hydrogen. This reaction is endothermic (requires heat). The “lean” LOHC can then be returned for reuse.

Advantages:

- Utilizes Existing Infrastructure: LOHCs can be transported using existing liquid fuel infrastructure (pipelines, tankers, storage tanks), significantly reducing upfront capital investment compared to dedicated hydrogen infrastructure.

- Ambient Temperature and Pressure Transport: Eliminates the need for cryogenic temperatures or high pressures during transport, leading to safer and more cost-effective logistics.

- High Volumetric Density: LOHCs can store a significant amount of hydrogen per unit volume, making them efficient for bulk transport.

- Safer Handling: LOHCs are typically non-flammable and have low vapor pressure, making them safer to handle than compressed or liquid hydrogen.

Disadvantages:

- Energy Intensive Dehydrogenation: The dehydrogenation process to release hydrogen from the LOHC requires significant energy input (heat), impacting the overall efficiency.

- Carrier Material Costs and Lifetime: The cost of the LOHC material itself and its long-term stability and reusability are critical factors. Degradation of the LOHC over multiple cycles could increase operational costs.

- Technology Still Developing: While promising, LOHC technology is still in the earlier stages of commercialization compared to compression and liquefaction, with ongoing research focused on improving efficiency and reducing costs.

- Catalyst Fouling: The catalysts used in the hydrogenation and dehydrogenation processes can be susceptible to fouling, which reduces their efficiency and lifetime.

b. Ammonia (NH3): A Hydrogen Shuttle

Ammonia is increasingly being recognized as an excellent hydrogen carrier. It is already a globally traded commodity, and its existing infrastructure for production, storage, and transport makes it an attractive option.

Advantages:

- High Hydrogen Density: Ammonia contains 17.65 wt% hydrogen, which is higher than LH2 on a volumetric basis.

- Established Global Infrastructure: A mature global infrastructure for ammonia production, storage, and transport already exists.

- Easier to Liquefy: Ammonia can be liquefied at -33°C (28 psi), requiring significantly less energy than hydrogen liquefaction.

- Direct Use: Ammonia can be used directly as a fuel in some applications or “cracked” back into hydrogen and nitrogen at the point of use.

Disadvantages:

- Toxicity: Ammonia is a toxic gas, requiring careful handling and stringent safety protocols.

- Energy for Cracking: Cracking ammonia back into hydrogen requires significant energy input.

- NOx Emissions (if used directly as fuel): Burning ammonia directly can produce nitrogen oxides (NOx) emissions, which are air pollutants, requiring abatement technologies.

The choice of storage and transport technology will depend on the specific application, distance, scale, and economic considerations. For Alberta’s ambitious export goals, LOHCs and ammonia present compelling advantages due to their ability to leverage existing infrastructure and offer safer, more efficient bulk transport over long distances.

Pipeline Retrofit: Blending Hydrogen into the Existing Network

For domestic distribution, particularly to industrial users and for heating applications, the concept of blending hydrogen into the existing natural gas pipeline network is gaining significant traction. This approach offers a cost-effective way to introduce hydrogen into the energy mix without requiring entirely new dedicated infrastructure.

The Viability and Cost of Blending

Research and pilot projects worldwide are exploring the technical feasibility, safety implications, and economic viability of injecting hydrogen into natural gas pipelines.

Technical Considerations:

- Material Compatibility: Hydrogen, being a smaller molecule than methane, can interact differently with pipeline materials. Embrittlement of steel pipelines and degradation of seals and gaskets are key concerns. Studies suggest that certain pipeline materials, particularly older ones, may be more susceptible to hydrogen embrittlement. Modern pipelines, often made of higher-grade steel, are generally more resilient.

- Leakage: Hydrogen’s smaller molecular size also increases the potential for leakage through seals, valves, and even the pipeline material itself. This can lead to safety concerns and product loss.

- Compressor Compatibility: Existing natural gas compressors may need modifications or replacements to handle hydrogen blends effectively, as hydrogen has different thermodynamic properties.

- End-Use Appliances: Appliances designed for natural gas may not function optimally or safely with high hydrogen blends. Combustion characteristics, flame speed, and heat output can be affected. Most studies suggest that blending up to 20% hydrogen by volume is generally manageable for most existing natural gas appliances with minimal or no modifications. Higher blends would necessitate significant upgrades or replacements.

- Metering and Billing: Accurately measuring and billing for hydrogen-natural gas blends requires new metering technologies and revised regulatory frameworks due to the differing energy content of hydrogen and methane.

Cost Implications:

- Lower Upfront Capital: The primary cost advantage of blending is the avoidance of building entirely new hydrogen pipelines, which can be astronomically expensive.

- Retrofit Costs: While blending reduces upfront costs, there will be retrofit costs associated with pipeline upgrades, compressor modifications, enhanced leak detection, and potential end-user appliance adjustments. These costs will vary significantly depending on the age and condition of the existing pipeline network.

- Operational Costs: Potential increases in operational costs might arise from more frequent inspections, enhanced safety protocols, and the energy required for compression.

The 20% Blend Sweet Spot

A consensus is emerging that a hydrogen blend of up to 20% by volume (approximately 7% by energy content) in natural gas pipelines is a reasonable and achievable target for many existing networks. This level is generally considered safe for most existing pipeline materials and end-use appliances without requiring extensive modifications. Beyond this threshold, the technical and economic challenges escalate significantly.

Benefits of Blending:

- Decarbonization Pathway: Blending hydrogen into the natural gas grid offers a practical and immediate pathway to reduce carbon emissions from heating, industrial processes, and power generation.

- Market Entry for Hydrogen: It allows for the gradual introduction of hydrogen into the energy market, building supply chains and demand while dedicated hydrogen infrastructure is developed.

- Flexibility: It provides flexibility in energy supply, allowing for greater utilization of intermittent renewable energy sources to produce green hydrogen.

Alberta’s Context:

Alberta’s extensive natural gas pipeline network presents a unique opportunity for hydrogen blending. The province’s experience in managing complex energy infrastructure provides a strong foundation. However, a thorough assessment of specific pipeline segments, their material composition, age, and existing pressure ratings will be crucial in determining the optimal blending strategy and associated costs. Regulatory frameworks will also need to evolve to support and incentivize hydrogen blending projects.

Major Projects: Companies Driving Hydrogen Storage and Transport Innovation

Several companies are actively working on innovative solutions to address the hydrogen storage and transport challenge, recognizing it as a critical enabler for the hydrogen economy.

1. Hydrogen Compression Solutions

Efficient and cost-effective compression is vital for both pipeline injection and high-pressure storage.

- Nel Hydrogen: A global leader in electrolyzer technology, Nel also offers advanced hydrogen fueling and compression solutions. Their compressors are designed for high efficiency and reliability, crucial for various applications from fueling stations to industrial supply. Nel’s robust compression technology can be integrated into large-scale hydrogen production facilities in Alberta, enabling efficient storage for local distribution or as a precursor for other carrier technologies.

- Burckhardt Compression: This Swiss company specializes in reciprocating compressors for gas applications, including hydrogen. Their extensive experience in high-pressure gas handling makes them a key player in developing durable and efficient hydrogen compressors for large-scale industrial use. Their technology could be instrumental in handling the volumes of hydrogen required for blending into pipelines or for preparing hydrogen for LOHC conversion.

- MAN Energy Solutions: With a focus on large-scale industrial solutions, MAN Energy Solutions is developing integrated compressor systems for hydrogen, particularly for power-to-gas applications and industrial off-takers. Their expertise in complex engineering projects positions them to contribute to the large-scale compression infrastructure needed for Alberta’s hydrogen ambitions.

2. Hydrogen Storage Solutions

Beyond compression, innovative storage solutions are emerging to enhance safety and density.

- Hexagon Purus: This Norwegian company is a leading provider of Type IV composite high-pressure cylinders and systems for hydrogen storage. These lightweight and durable tanks are crucial for storing compressed hydrogen safely in vehicles, trailers for transport, and stationary applications. Their technology is vital for both smaller-scale distribution and for optimizing the payload of hydrogen transport trailers, making them relevant for Alberta’s potential short-haul hydrogen logistics.

- Hyzon Motors: While primarily known for fuel cell electric trucks, Hyzon Motors is also developing integrated hydrogen storage solutions for their heavy-duty vehicles, emphasizing efficient and safe on-board storage. Their focus on practical, operational storage solutions in the transport sector will provide valuable insights into real-world performance requirements.

- Plug Power: A major player in the hydrogen ecosystem, Plug Power is expanding its offerings to include comprehensive hydrogen infrastructure, encompassing liquefaction and cryogenic storage solutions alongside their electrolyzer and fuel cell technologies. Their move into liquefaction indicates a commitment to addressing the high-density storage needs for large-scale distribution and potential export from regions like Alberta.

3. Carrier Technology Developers (LOHCs and Ammonia)

These companies are at the forefront of enabling long-distance, large-volume hydrogen transport via chemical carriers.

- Hydrogenious LOHC Technologies: This German company is a pioneer in LOHC technology, focusing on the safe and efficient storage and transport of hydrogen using benzyltoluene as the carrier. They have successfully demonstrated their technology in pilot projects, including a fully integrated LOHC transport chain. Their modular LOHC systems could be deployed at production sites in Alberta and at receiving terminals abroad, providing a robust solution for large-scale hydrogen export.

- Chiyoda Corporation: The Japanese engineering giant has developed and commercialized its “SPERA Hydrogen” system, which uses methylcyclohexane (MCH) as an LOHC. This technology has been successfully demonstrated in international hydrogen supply chains, most notably between Brunei and Japan. Chiyoda’s proven track record with large-scale LOHC deployment makes them a crucial partner for Alberta’s export aspirations, providing a blueprint for establishing long-distance hydrogen supply chains.

- Fortescue Future Industries (FFI): While a broad player in green hydrogen, FFI is making significant investments in ammonia production and its use as a hydrogen carrier. They are developing large-scale green ammonia projects globally, with an emphasis on its role in transporting hydrogen over intercontinental distances. Their strategic focus on ammonia aligns well with Alberta’s potential for large-scale hydrogen production and export using an established global commodity.

- Air Products: A global industrial gas leader, Air Products is investing heavily in large-scale “blue” and “green” hydrogen projects, often incorporating ammonia as a carrier for transport. Their expertise in gas processing, liquefaction, and global logistics positions them as a key player in developing the infrastructure required for transporting hydrogen, whether as pure hydrogen, LH2, or via ammonia.

These companies represent a diverse array of approaches, each contributing to the multifaceted solution required for hydrogen’s last mile. For Alberta, engaging with these innovators, attracting their investment, and fostering local expertise in these areas will be paramount to building a robust and competitive hydrogen economy.

Bridging the Gap: From Technical Challenges to Investment Opportunities

The technical challenges of hydrogen storage and transport, while significant, also represent substantial investment opportunities. For Alberta, success in this arena means:

- Job Creation: Development of new infrastructure, manufacturing of specialized equipment, and operational roles in the hydrogen supply chain will create thousands of high-skilled jobs.

- Economic Diversification: Moving beyond traditional oil and gas to embrace hydrogen positions Alberta as a leader in the global clean energy transition, diversifying its economy.

- Export Revenue: Establishing efficient hydrogen export pathways (via LOHCs, ammonia, or potentially LH2) will unlock significant new revenue streams for the province.

- Technological Innovation Hub: Alberta can become a hub for research, development, and deployment of cutting-edge hydrogen technologies, attracting further investment and talent.

Investors will be looking for projects that demonstrate:

- Scalability: Solutions that can transition from pilot projects to commercial-scale operations efficiently.

- Cost-Effectiveness: Technologies that can deliver hydrogen to end-users at a competitive price point, considering the entire value chain.

- Safety and Reliability: Proven safety records and robust operational reliability are critical for investor confidence and public acceptance.

- Integration with Existing Infrastructure: Projects that can strategically leverage Alberta’s existing energy infrastructure (pipelines, industrial sites, skilled workforce) will have a distinct advantage.

The “last mile” is arguably the most complex and capital-intensive segment of the hydrogen value chain. However, by strategically investing in and developing innovative storage and transport solutions, Alberta can transform this challenge into its greatest opportunity, solidifying its position as a global leader in clean hydrogen production and export. The journey ahead requires collaboration between industry, government, academia, and the investment community, but the potential rewards for Alberta’s future are immense.

Article Sources

1. The Trade-Off: Storage and Transport Efficiency

- Hydrogen Storage | Department of Energy

- A Review of Hydrogen Storage and Transportation: Progresses and Challenges – MDPI

- Liquid Organic Hydrogen Carrier (LOHC) – Honeywell UOP

2. Pipeline Retrofit: Blending Viability and Cost

- Hydrogen Strategy for Canada: Progress Report

- Hydrogen Roadmap | Alberta.ca

- Green Hydrogen as an Additive to Natural Gas Pipelines – Schulich School of Engineering – University of Calgary